Innovation economy

Broadly diversified venture and growth strategy, emphasizing best-in-class managers across all sectors of the innovation economy

Open architecture

Seeks to produce superior risk-adjusted returns with low volatility through secondary, primary direct and primary fund investments

Investor-friendly

Immediate exposure to venture capital and growth equity investments with low investment minimums and quarterly liquidity1

The Fund is not obligated to redeem any shares, and approval is at the Board of Trustees’ discretion. The share redemption plan is subject to 2.5% of the Fund’s outstanding shares per quarter and to other limitations, and the Board may modify, suspend or terminate the plan. Please see the Prospectus for a full discussion regarding liquidity/share repurchase limitations.

Extended opportunities for private market value capture

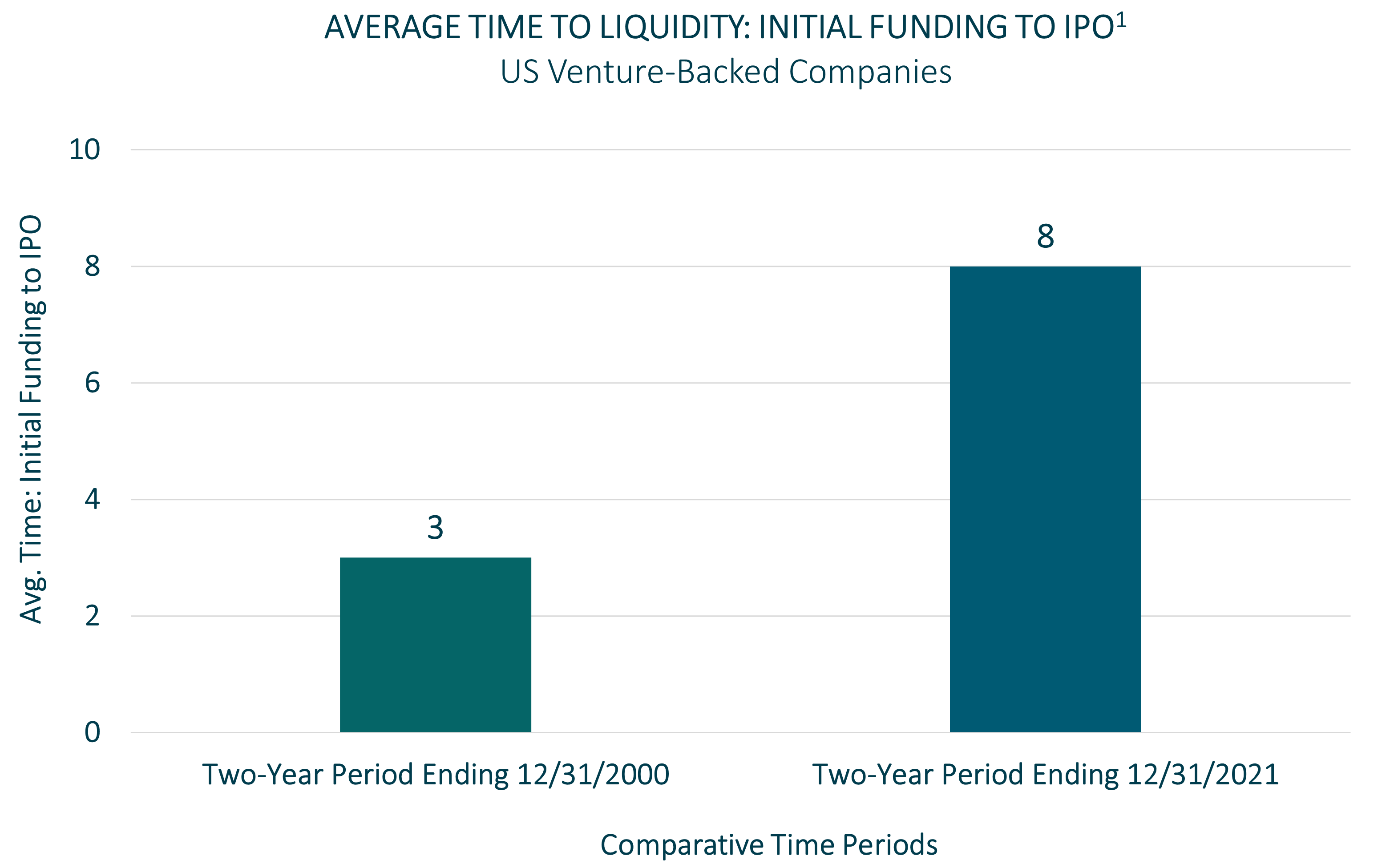

Companies have stayed private longer

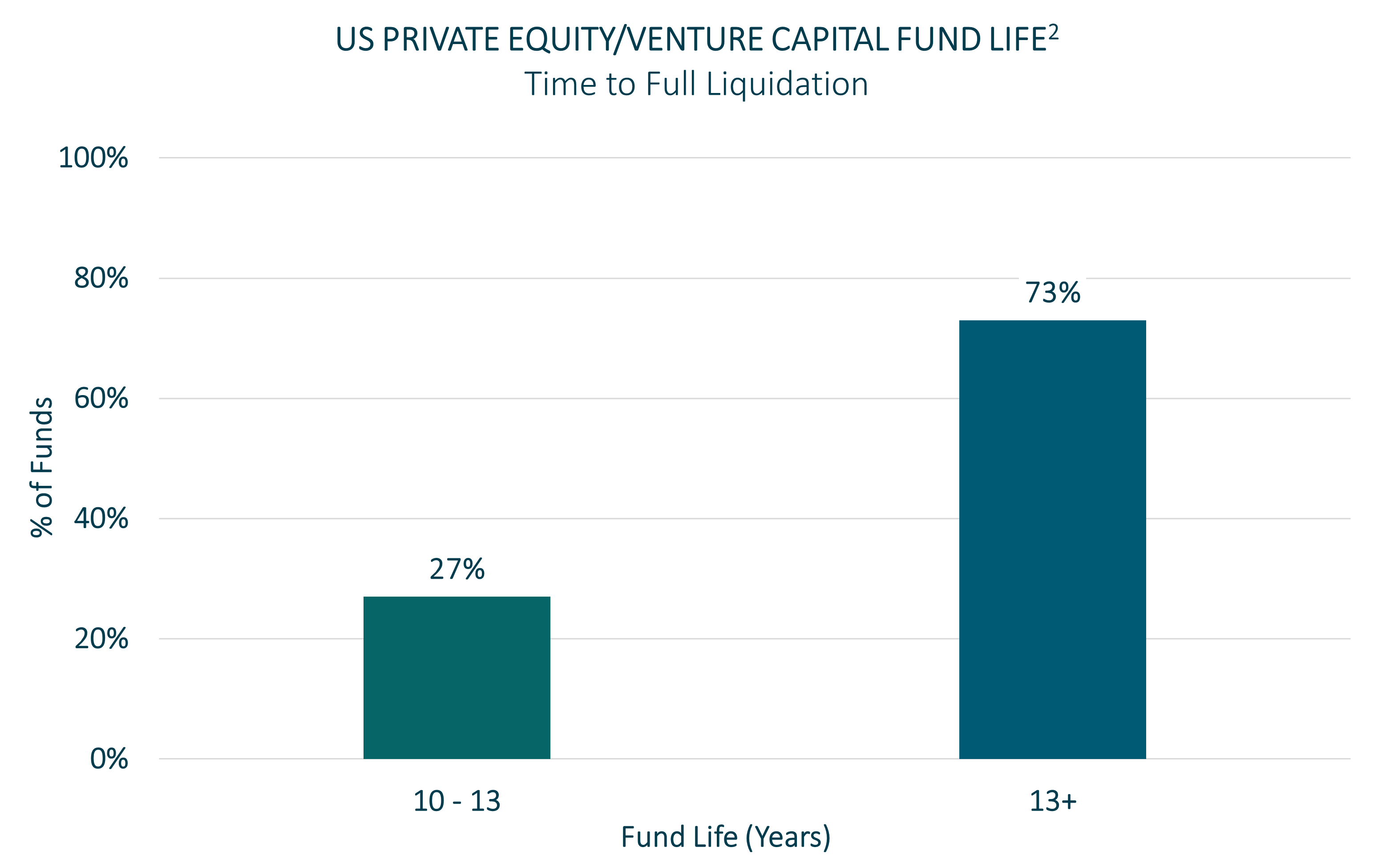

Venture fund lifespans have continued to increase

Information is subject to change and is not a guarantee of future results.

- Average Time from Initial Equity Funding to IPO (Initial Public Offering): ThomsonOne as of December 31, 2021.

- US Private Equity/Venture Capital Fund Life: InstitutionalInvestor.com, ”The New Reality of the 14-Year Venture Capital Fund. February 2015.”

Historically, the private markets and specifically venture capital investments have been difficult to access. However, performing well goes far beyond simply having access.

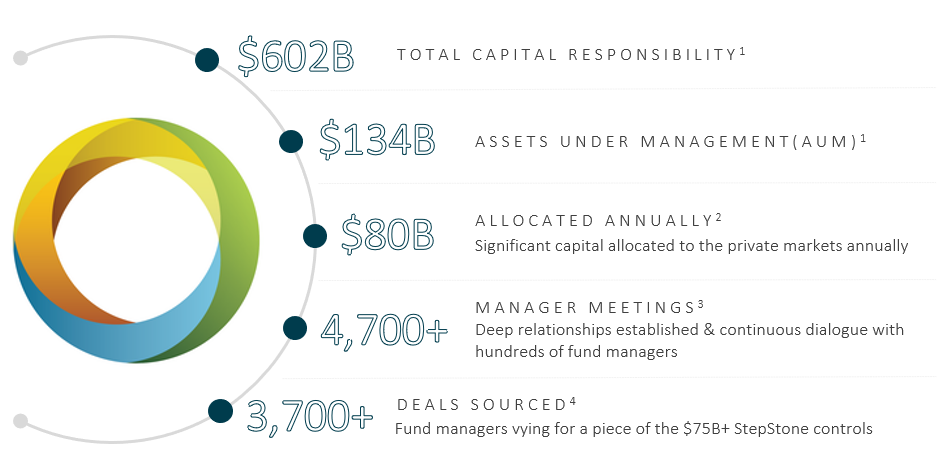

Leveraging StepStone’s global platform

StepStone is one of the largest private markets investment managers in the world with unparalleled access to deal flow and a proprietary suite of integrated data and technology solutions, allowing us to perform comprehensive due diligence and make better investment decisions.

All dollars are USD. Data includes Greenspring Associates metrics.

$602B includes $135B in assets under management and $467B in assets under advisement. Reflects final data for the prior period (June 30, 2022), adjusted for net new client account activity through September 30, 2022. Does not include post-period investment valuation or cash activity. NAV data for underlying investments as of June 30, 2022, as reported by underlying managers up to 100 days following June 30, 2022. When NAV data is not available by 100 days following June 30, 2022, such NAVs are adjusted for cash activity following the last available reported NAV.

212 months ending December 31, 2021. Excludes legacy funds, feeder funds and research-only, non-advisory services.

312 months ending September 30, 2022.

412 months ending September 30, 2022. Includes all ofStepStone’s private markets asset classes: Private Equity, Private Debt and Real Assets.

5As of June 30, 2022

SPRING™ investment strategy overview

SPRING™ portfolio construction1

Secondary

Investments2 (50%-70%)

Primary

Direct (20%-40%)

Primary

Fund (5%-15%)

Venture

Capital (60%-75%)

Growth

Equity (20%-35%)

Other Private

Market (0%-10%)

Risk mitigated approach3

For illustrative purposes only.

- There can be no guarantee that the fund’s ultimate composition will reflect the above targets.

- Secondary investments will include a combination of direct secondaries and fund interests.

- Not indicative of future returns.

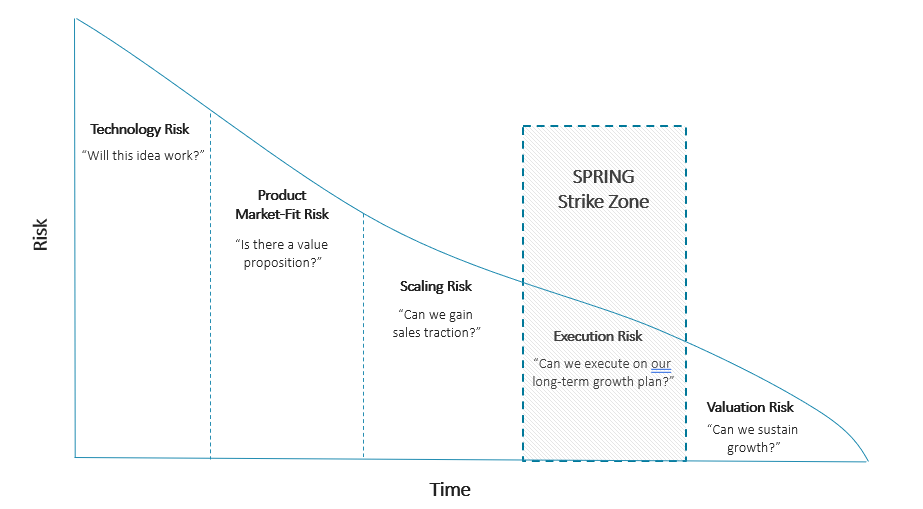

SPRING investment strategy

| Challenges of Venture Capital Asset Class1 | The SPRING™ Approach |

|---|---|

| Manager & Asset Volatility | Focus on growth stage assets with potentially lower risk Direct Investments, Secondaries and Seasoned Primaries significantly reduce blind pool risk |

| Scalability | Open architecture allows capital to be immediately put to work and meet allocation targets |

| Partial Liquidity | Tender fund offering quarterly liquidity of 2.5% via regular redemptions/tender offers2 |

| Ability to Invest | Offered to qualified clients and accredited investors as opposed to qualified purchasers3 |

| Time To Liquidity for Venture Investments | Secondaries can offer shorter time to liquidity Target growth stage direct investments with 3-5 year expected hold periods |

| Access & Due Diligence | Leverages StepStone’s global research platform Sourcing and due diligence enhanced by relationships, reporting and technology |

- Venture Capital Asset Class challenges as identified by StepStone Group. Source: StepStone Group, June 30, 2022.

- The Fund is not obligated to redeem any shares, and approval is at the Board of Trustees’ discretion. The share redemption plan is subject to 2.5% of the Fund’s outstanding shares per quarter and to other limitations, and the Board may modify, suspend or terminate the plan. Please see the Prospectus for a full discussion regarding liquidity/share repurchase limitations

- Qualified purchaser represents an individual or a family-owned business that owns $5 million or more in investments. Qualified clients represents an individual with at least $2.1 million in investable assets. Accredited Investors within the meaning of Rule 501 of Regulation D under the Securities Act of 1933 such as a natural person with at least a $1 million net worth or income exceeding $200,000 or joint income with a spouse exceeding $300,000. Please refer to the subscription documents for more details.

There can be no assurance that the Fund will be able to achieve its investment objectives, strategies, or avoid substantial losses.

Interested in more information about SPRING™?

Let us know how we can help:

"*" indicates required fields