Aligning investor interests, building trust

Simplifying your investment process

Seeking enhanced portfolio outcomes

Much of the growth, value creation and opportunity has been taking place in the private vs. public markets.

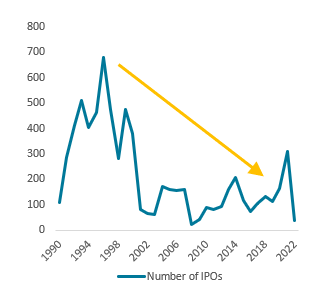

Number of US IPOs per year1

Companies have been staying private 2x longer

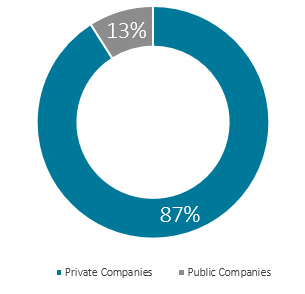

Current blend of US private vs. public companies2

7x more private than public companies

1Jay R. Ritter. January 2023. Initial Public Offerings: Updated Statistics. https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf

2Capital IQ (January 2022). Note: 87% represents private US companies with >$100M in revenue.

Historically, the private markets have been opaque and difficult to access. However, performing well goes far beyond simply having access.

Historically, it has been difficult for high net worth individual investors and smaller institutions to get diversified exposure to the private markets for the following reasons:

1K-1’s offer potential tax flow-through benefits for investors but also include added complexity.

Leveraging StepStone’s global platform

StepStone is one of the largest private markets investment managers in the world with unparalleled access to deal flow and a proprietary suite of integrated data and technology solutions, allowing them to perform comprehensive due diligence and make better investment decisions.

StepStone’s proprietary private markets database, SPI, tracks the information of:4

All dollars are USD.

1Total capital responsibility equals Assets Under Management (AUM) plus Assets Under Advisement (AUA). AUM includes any accounts for which StepStone Group has full discretion over the investment decisions, has responsibility to arrange or effectuate transactions, or has custody of assets. AUA refers to accounts for which StepStone Group provides advice or consultation but for which the firm does not have discretionary authority, responsibility to arrange or effectuate transactions, or custody of assets. $640B in total capital responsibility includes $143B in AUM and $497B in AUA. Reflects final data for the prior period (March 31, 2023), adjusted for net new client account activity through June 30, 2023. Does not include post-period investment valuation or cash activity. NAV data for underlying investments as of March 31, 2023, as reported by underlying managers up to 100 days following March 31, 2023. When NAV data is not available by 100 days following March 31, 2023, such NAVs are adjusted for cash activity following the last available reported NAV.

2For the twelve months ended December 31, 2022. Excludes legacy funds, feeder funds and research-only, non-advisory services.

312 months ending January 31, 2023. Includes all of StepStone’s private markets asset classes: Private Equity, Private Debt and Real Assets.

4Data reflecting twelve months ended June 30, 2023.

SPRIM – comprehensive private markets access

SPRIM is a core private markets holding, which may provide high net worth individuals and smaller institutions with fully diversified exposure to the private markets, available via a convenient, efficient and transparent product.

Globally diversified private market investments within a single fund

Intends to provide superior risk-adjusted returns

Unique access to deal flow, global scale, and information advantage

Seeking to reduce portfolio volatility

Securities in the private markets lack the daily price transparency of securities in the public markets.

There are no assurances these objectives will be met. SPRIM™ may be considered speculative, has substantial costs and is not suitable for all investors. The investment’s share price is evaluated less frequently which does not indicate stability in the value of the underlying assets. Investors will have limited liquidity. SPRIM™ is not obligated to redeem any shares, and approval is at the Board of Trustees’ discretion. The share redemption plan is subject to other limitations, and the Board may modify, suspend or terminate the plan.

Interested in more information about SPRIM? Let us know how we can help.

"*" indicates required fields