*“All-weather” refers here to private debt as an asset class. It is expected that a broadly diversified private debt portfolio may generate long-term attractive returns in favorable market environments, while reducing volatility and maximum drawdowns in adverse market conditions.

January 20, 2023

The current economic environment represents a high degree of complexity and centers around one question: Will central banks still manage to achieve a soft landing? This document aims to highlight the implications for corporate direct lending caused by the three key macroeconomic variables: inflation, interest rates and growth. The bottom line: We consider private debt to be an all-weather* asset class, capable of handling what appears to be an uncertain outlook.

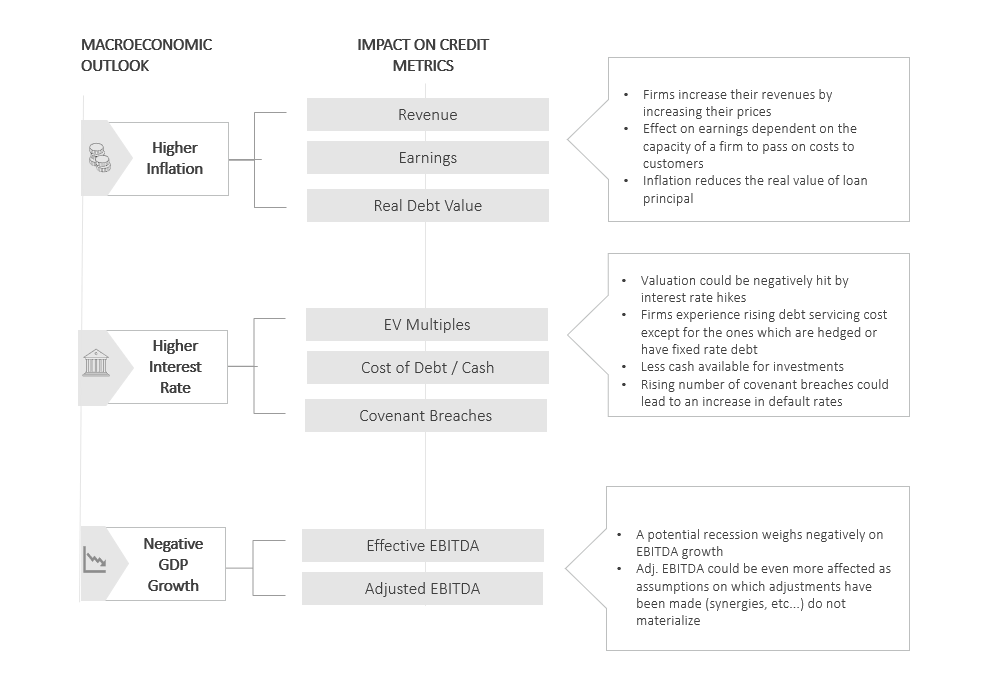

Setting the Stage: The Three Macroeconomic Variables

Inflation: Peaking and expected to moderate in 2023

- 2022 evokes a rude awakening after inflation in the US and Europe rose to its highest level in decades.

- Although monetary policy effectively manages aggregate demand, central banks are ill-equipped to deal with the supply component of inflation. A shallow recession may not be enough to reduce inflation toward major central banks’ target rate of around 2%.

- Thus, while inflation is expected to moderate entering 2023, it may remain elevated until geopolitical and supply chain situations resolve.

Rates: Faster, higher, longer?

- Central banks are raising rates at a staggering pace to catch up with inflation after maintaining a dovish monetary policy in the second half of 2021 when policymakers were convinced that the inflationary pressure was transitory.

- The pace of increases is perhaps more alarming than the magnitude. For example, USD Libor increased by more than 400 basis points in a year (see Figure 1).

- The peak in short-term interest rates remains unseen as forward rates indicate further increases.

- As central banks prepare to fight inflation — even at the cost of GDP growth — rates may persist at elevated levels.

Growth: Some risk to the downside

- Inflation and the subsequent rise in short-term rates will affect real GDP growth. The magnitude, however, is still unknown, particularly as post-Covid recovery is abating.

- In reaction, market participants recently lowered their growth expectations for 2023 rather significantly in some cases. Recent projections show the UK and Eurozone heading for a mild recession in 2023 with the US just managing to avert one.

- These projections present some risks. That’s particularly the case for Europe, where geopolitical tensions could tip the balance and push those economies into more severe downturns.

Impact on Corporates

A decade of low interest rates and borrower-friendly credit terms significantly influenced the capital structure of corporates, as they found a cheap source of financing in debt instruments. The current macroeconomic environment may prove challenging for the corporate sector as borrowers face earnings compression due to inflation, higher interest payments and a possible recession. The first signs of these stressors in various sectors are starting to show up in corporate financials.

In the third quarter of 2022, middle-market companies experienced their first negative, albeit immaterial and short-lived, earnings growth since 2020. The last quarter of 2022 depicts brighter days, but optimism must be tempered as market participants expect a sluggish growth picture for 2023.

Inflation impact: A mixed bag

Unlike rising interest rates, inflation’s effects on corporates depend on the industry and the competitive environments in which they operate. The difficulty for some industries, such as durable goods or airlines, to pass costs through to consumers may lead to margin compression and lower earnings, even though revenues may rise.

In competitive markets with low concentration and high price elasticity of demand, companies might be reluctant to pass through costs, as inflation also negatively affects households. As a result, highly cyclical industries, or those more exposed to higher input and energy prices, will suffer more relative to defensive sectors with more diversified cost bases. Additionally, some industries (e.g., energy) may, in fact, exhibit net benefits in an inflationary environment. Thus, inflation impacts corporates to different degrees.

For levered companies, inflation can be a positive as it reduces the real value of their debt, causing them to appear less risky.

From an investor’s perspective, inflation comprises undesirable effects, including potential increases in losses due to worsened company performance and a devaluation of principal. Thankfully, private debt is able to address both problems with its floating rate feature that offers, at least partially, protection against rising inflation and higher credit losses.

Interest rates: Manageable

Higher interest rates will generate repercussions on the cost of servicing debt and on covenant compliance. In both cases, higher rates may lead to an increase in default rates, particularly for companies with stretched balance sheets. However, on average, companies in the middle market feature comfortable interest rate coverage levels that help them absorb the increased cost of debt. Further, borrowers with the foresight to hedge their floating interest rate charges into fixed payments will be much better positioned to face this challenge. Companies exposed to floating rates may find themselves restricted in their ability to make new investments as their available cash shrinks due to higher interest payments. Their capabilities to fund new Capex spending and new innovations would be limited. Therefore, firms could miss productivity gains essential for their growth.

Growth: The big unknown

Inflation can be manageable if companies can successfully pass higher costs on to consumers. Similarly, servicing more expensive debt is conditional on corporate earnings remaining strong. Thus, all the above headwinds are bearable if the economic environment remains resilient. A decrease in economic growth may bring down EBITDA figures, throwing corporates out of balance. As a result, growth constitutes the most important factor in the equation as it could bring substantial downside risk in the future. Defensive sectors, less affected by the business cycle, should provide more protection to portfolios.

Source: StepStone Group. For illustrative purposes only.

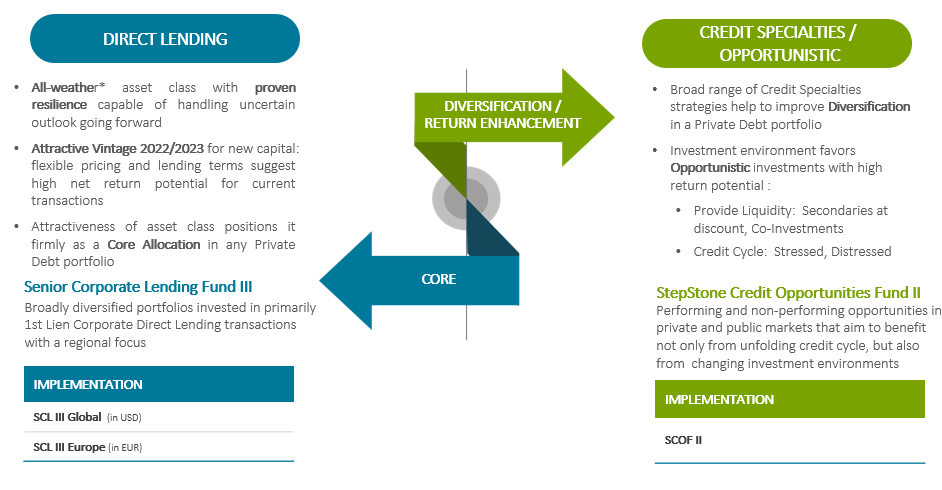

Private Debt: An All-Weather* Investment in an Uncertain Environment

Since private debt is populated mainly by first-lien loans positioned at the top of a company’s capital structure, we believe it possesses the defensive profile investors need through poor economic conditions. At the same time, it has delivered attractive returns relative to other asset classes in times of economic turmoil. In other words: Private debt has historically produced equity-like returns while limiting drawdowns. This has been proven through the GFC, Covid-19 and the recent market sell-off in 2022. Investors should also expect private debt to provide some protection against inflation thanks to its floating rate feature.

Floating rates are also synonymous with low-duration risk relative to other fixed-income instruments. Further, sponsor-backed lending provides some safety as borrowers maintain access to the private equity sponsor’s expertise to navigate economic turmoil. Lastly, the more challenging investment environment led to more favorable lending terms, which creates a particularly interesting opportunity for deploying capital into private debt at this time.

Existing Direct Lending Portfolios: Expected to Deliver Resilience Again

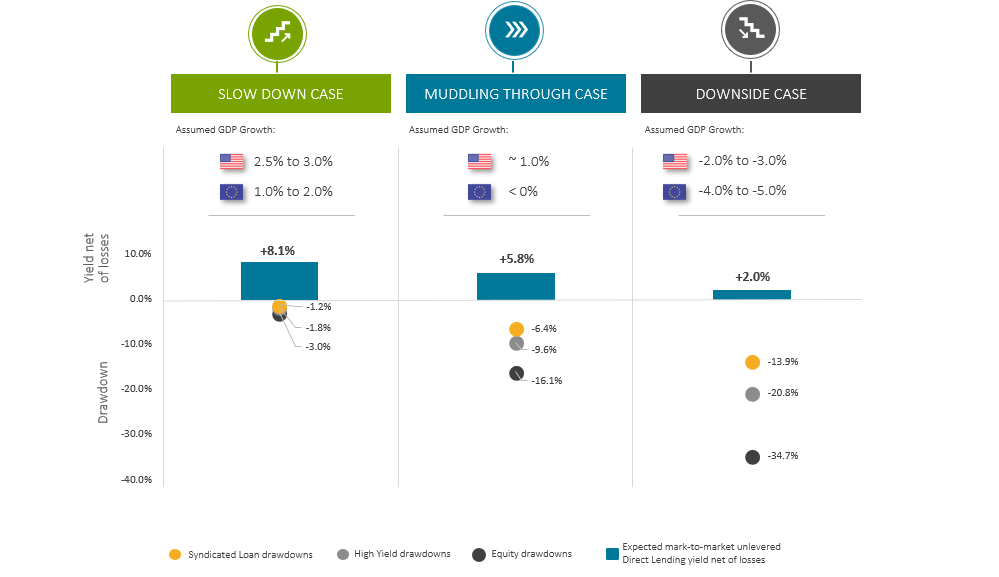

Considering Direct Lending’s track record of resilience, we are confident about the asset class’s future performance. Key drivers will comprise the persistence of inflation, the level of interest rates and the depth of a recession. To get a sense of how an invested, broadly diversified Direct Lending portfolio might perform, we run three scenarios:

- Slow Down Case—Inflation peaks, geopolitical tensions cools, and supply chain and energy price pressures abate. Central banks will continue increasing their policy rates but with lower increments, thus limiting a potential recession.

- Muddle Through Case— The Russian invasion drags on, energy prices remain high, and supply chain pressures persist. Central banks will be forced to continue with contractionary policies, thus tipping Western Europe, including the UK, into a recession due to its higher exposure to the economic sanctions imposed on Russia and its dependence on Russian gas.

- Downside Case—The war worsens, new conflicts potentially emerge in the Middle East, or a breakdown of US-China relations occurs, lockdown measures return due to new Covid waves, or some combination exacerbates inflation and forces central banks to increase their tightening pace. As a result, the world would enter a global recession.

In each scenario, direct lending has compared favorably with other asset classes, generating a low drawdown and thus proving its resilience in stressed environments. Despite the headwinds detailed above, private debt holds the potential to provide investors with superior risk-adjusted returns and mitigated risk compared to other asset classes.

The following table quantifies how different scenarios impact projected returns. As an example, the 5.8% for the “Muddling Through Case” scenario illustrates the investment result for 12 months after deducting the impairments (realized and unrealized losses) caused by the scenario’s inflation, interest rates and growth assumptions. The result is a reasonable absolute outcome and compares favorably to the drawdowns of other asset classes. As a result, despite elevated inflation, high interest rates and muted growth expected in the “Muddling Through Case”, private debt seems well positioned to withstand potential upcoming market turmoil. Importantly, even in the Downside Case, we expect to generate a positive return that may be achieved.

Please note the exposure of the illustrative LP portfolio is US 85%; EU 13%; Cash 2%. Direct Lending return in the current market scenario based on StepStone estimations as of September 2022. Source: StepStone Analysis. SSL price decline is estimated using historic relationship between credit losses and price declines, HY and equity price declines are derived from market betas relative to SSL. For actual market data Credit Suisse indices and SPX is used. General assumptions include: For illustrative purposes only. Certain assumptions have been made for modeling purposes and are unlikely to be realized. No representations and warranties are made as to the reasonableness of the assumptions.

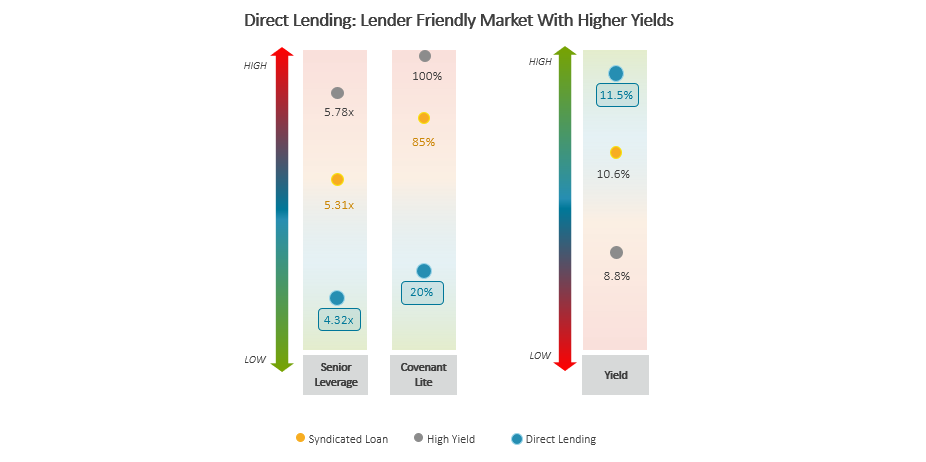

New Capital: Attractive Vintages For New Money Thanks to Lender Friendly Terms

When compared to other fixed-income asset class, direct lending has demonstrated its relative advantage in terms of risk/return profile. On the figure below, direct lending demonstrates the lowest potential risk (i.e., lowest leverage) while offering the highest compensation in terms of yield. Not only is the yield higher for direct lending but syndicated loans and high yield must also incorporate material allocations to covenant-light loans and high senior leverage to push their yields closer to direct lending. Thus, entering high yield and syndicated loan markets today would require assuming outsized credit risk in order to achieve higher yields while direct lending would comprise newly originated loans in the primary market, characterized by more lender friendly terms. As a result, the upcoming vintage may represent one of the best in the history of direct lending, entailing relatively low risk while offering potentially high returns. This dynamic would not be unprecedented as the period following the GFC generated the asset class’s best vintages thus far. We believe now is the time to capture the upcoming opportunities in the direct lending space.

Source: Refinitiv LPC Q3 2022, StepStone Group and Credit Suisse, as of November 2022.

Additionally, the upcoming troubled times are not only a source of challenges but, in our opinion, also a time of many opportunities for the asset class. A more challenging fundamental environment and the potential withdrawal of liquidity can present many distressed investment opportunities with attractive risk-adjusted return profiles that we believe private debt is well positioned to capture. The opportunity set of the distressed space is further enhanced as banks’ reduced risk appetites would lead to hung syndications while liquidity needs could provide secondary offerings at discounts. Finally, credit specialties strategies could provide further portfolio diversification with attractive risk/return profiles in times of market stress, as high correlation between risk-free and risky assets leaves little room for diversification.

Conclusion

While the macroeconomic outlook has become more challenging since the post-Covid recovery, we believe private debt is well positioned to demonstrate its all-weather* relevance to institutional investors. Its position in the capital structure and features such as floating rate coupons are important reasons why. Furthermore, depending on the scenario, the economic environment adds outsized opportunistic return opportunities in distressed and credit specialties strategies with potentially more attractive risk-adjusted returns than equities. Through recent crises, the asset class exhibited attractive risk-adjusted returns and limited drawdowns, demonstrating its defensive and resilient nature when most needed. Based on our scenario analysis, we believe the same should hold true in 2023.

StepStone Insights: The Persistence of Opportunistic Credit

During StepStone’s 2022 360 Investor Conference in New York City, partners John Bohill and Marc-André Mittermayer discussed opportunistic credit, homing in on the importance of diversification and being perennially invested in the private debt space.