This whitepaper was produced in partnership with GIC.

Introduction

This paper aims to provide an overview of private debt investment opportunities and introduce a systematic framework for optimizing private debt allocations in institutional portfolios. It consists of three key components:

- First, we model the risk and return considerations for a comprehensive range of private debt assets. Due to the unique nature of private markets, it is challenging to find measures that can reflect fundamental drivers while remaining consistent with the risk-return metrics for portfolio construction in public markets. We propose using net credit spread and credit stress loss as return and risk measures as they satisfy both requirements.

- Second, we determine what we believe to be the ideal composition of private debt portfolios at different levels of target return using a robust optimization approach with capacity constraints. Through a case study, we demonstrate how investors can effectively integrate private debt into a 60/40 portfolio to achieve various investment objectives such as enhancing returns or reducing risk.

- Last, we discuss the implementation of a private debt allocation and ways to enhance risk-reward using dynamic and opportunistic levers.

The private debt investment landscape

Building robust portfolios has always been a core objective for investors. In recent decades, the traditional 60/40 portfolio has been able to broadly achieve this, supported by falling rates and stable inflation. However, the outlook going forward could be less ideal. In this uncertain and challenging environment, many institutional investors believe that a well-diversified portfolio with alternative assets offers the potential to enhance risk-adjusted returns and provide resilience.

One asset class that has seen growing institutional interest in this context is private debt. With a large and heterogeneous universe, it presents a rich opportunity set for attractive absolute returns and diversification across fundamental drivers. Despite the increasing attention, however, public information on the asset class remains limited. This paper aspires to shed light on the private debt landscape, present a fundamental approach to evaluate risk-reward across segments, and obtain a private debt allocation tailored to investors’ needs.

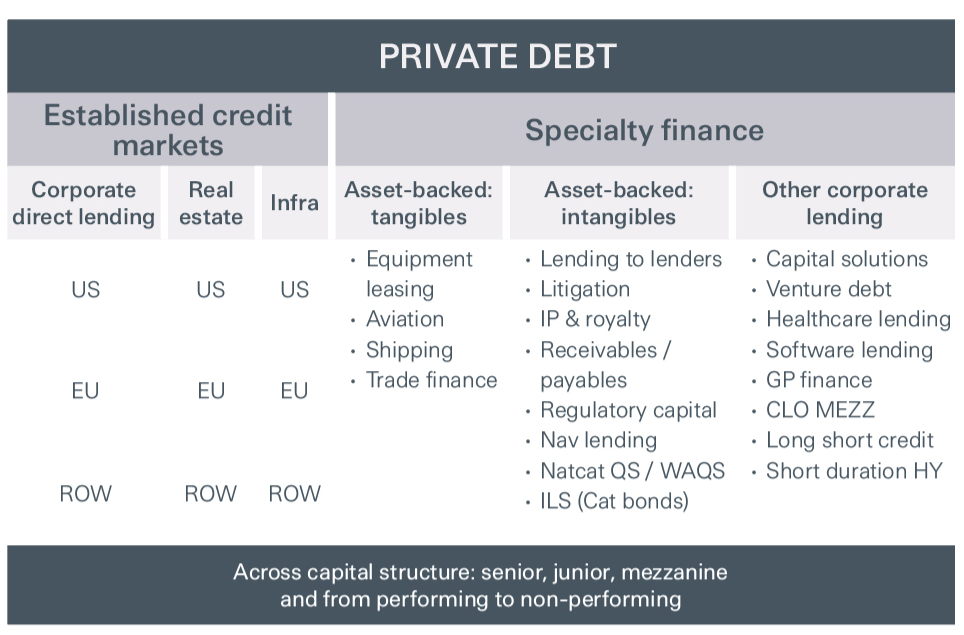

While corporate direct lending is the most established market, the wider private credit universe has developed over time to include a spectrum of opportunities. The universe can broadly be characterized along two key dimensions: position in the capital structure, and collateral type. As illustrated in Figure 1, financing needs covered by private credit go beyond corporate debt and include real assets such as real estate and infrastructure debt, but also niche specialty finance segments such as net asset value (NAV) financing and equipment leasing. Credit assets range from senior debt, which ranks highest in the capital stack, to second lien and mezzanine, which are junior, and preferred equity, which lies just above common equity and often possesses hybrid debt-equity characteristics. Finally, nonperforming credit or restructurings possess more equity-like characteristics.

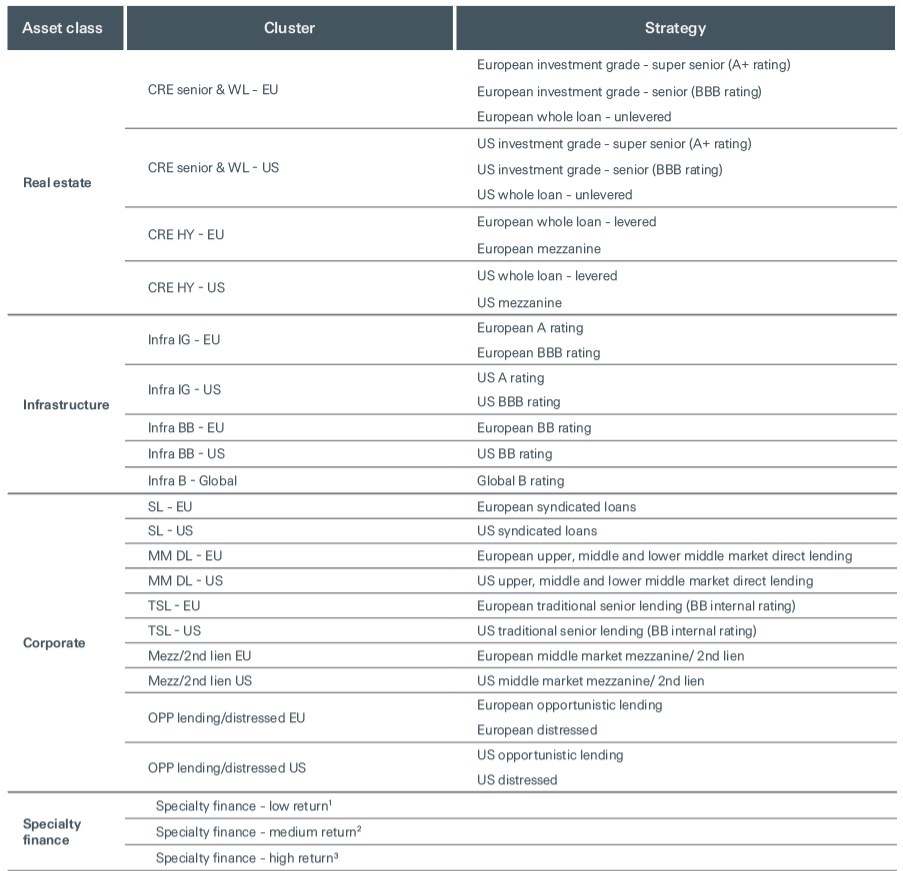

Figure 1 | The private debt landscape extends over a broad range of strategies, collateral, types, regions and level of seniority

Sources: StepStone Group and GIC, as of June 2023.

Private debt assets are generally expected to offer higher returns relative to public credit, reflecting risk premiums arising from illiquidity and accessibility. Within the private debt realm, more niche specialty finance as well as opportunistic and distressed assets have the potential to offer even higher returns, further compensating for complexity and funding gaps. While this is generally true, each credit segment has unique and evolving market dynamics, requiring active monitoring of pricing and valuations across assets. In the implementation section, we will elaborate on how relative value may evolve and how investors can potentially enhance the returns of their private debt portfolios with a more dynamic and opportunistic approach.

In this study, we take a comprehensive approach to the private credit universe consisting of 13 main strategies, divided into 57 different sub-strategies and covering predominantly the US and Europe. For each sub-strategy, we maintain a set of 25 measures including spreads, loss rates, stress losses, duration, and annual deployment capacities, which are updated regularly. Each strategy offers a different risk-return profile with varying drivers and can thus play a different role in a strategic asset allocation. Using over 50 sub-strategies for assets allocation decisions is complex. To reduce that complexity and focus on core drivers for portfolio construction, we cluster sub-strategies into groups with similar risk-return profiles. This grouping of sub-strategies is done through a qualitative assessment of each strategy, a quantitative assessment of its correlations, and clustering techniques to identify similar risk-return profiles, as depicted in Figure 2.

Figure 2 | Clustering of credit strategies for the purpose of asset allocation4